If you’re considering replacing your car, the first decision on your car-buying journey is whether to buy new or used. Here are 10 points in favour of the latter, and some top tips on what to watch out for.

- 1. Depreciation

- 2. Choice

- 3. More Car for Your Money

- 4. Approved Used

- 5. Durability

- 6. Data

- 7. Appreciation

- 8. Beat the Tax Changes

- 9. History Checks

- 10. Wondering About a Warranty?

- Myth Busting: What About Insurance?

1. Depreciation

Almost every brand new car sold in the UK each year (and in 2022 there were 1.61 million of them) loses a serious chunk of its value the moment it is driven out of the forecourt. By the time three years have passed, it could be worth close to half its initial value, or possibly even less. By buying used, you suffer far less depreciation, and let the previous owner take the financial hit for you, which massively lowers overall running costs.

2. Choice

Buyers are hardly stuck for choice when browsing the new car market, but new car variety has nothing on what you can find with pre-owned cars. No matter what combination of body style, engine, boot size, seat configuration, and fuel consumption you’re after, the wide selection means something, somewhere will fit the bill. You can also find models or body styles that have since been discontinued, such as hot hatches without turbochargers (old favourites among enthusiasts) or small cars with big engines. Between listings, franchise dealers, used car dealers, auction houses and private sales, the world is your oyster.

3. More Car for Your Money

No matter if your budget is £10,000 or £100,000, it is impossible not to be impressed by how much money you can save when buying a used - rather than a new - vehicle, and that's before you've started haggling. For example, if the idea of a bog-standard new hatchback makes you want to curl up for a snooze, the lower purchase price of its used equivalent could allow you access to the high-performance version. You can still get finance for a used vehicle and make monthly payments for your motoring, and if you buy from a dealer, you may be able to part-exchange your existing car. But you could also take out a personal loan from a bank or building society, or even pay for it on a credit card.

4. Approved Used

When it comes to approved used car schemes, manufacturers and car dealers will sell only the very best cars they can source. Almost all approved used cars have low mileage, are less than three years old, and some are nearly new cars with no more than one owner. Each will have been through a detailed inspection and a history check, and will have had any faults put right prior to sale, so they’re usually in very good condition. Cars will likely come with a full service and MOT history in the logbook, a manufacturer warranty, MOT test cover and no risk of any outstanding finance. Most schemes also give you breakdown cover from organisations like the AA or the RAC.

You will pay a premium for buying an approved used car from a dealership compared to from a private seller, but they are still significantly cheaper than their brand new equivalents. They also provide extra peace of mind, because if anything does go wrong, you should have some comeback. This is also the case if you buy from a car dealer rather than a private seller, as you have more rights under the Consumer Rights Act.

5. Durability

While there are still exceptions, the vast majority of modern cars are more durable than their predecessors. Engines and gearboxes that have been serviced to schedule can comfortably last far beyond the 100,000-mile point. Bodywork is much more resistant to corrosion than it used to be, and components such as suspension, brakes, and clutches can be replaced when needed. Having said that, we'd still recommend checking the paintwork for dents and imperfections, and getting behind the steering wheel to take a test drive before signing on the dotted line.

6. Data

Whether it’s a car’s reliability record or how competitively priced it is, there is a lot more data to be found relating to second-hand cars than new ones. CarGurus, for example, uses data (lots and lots of data – it’s what we do) to provide the Instant Market Value of a vehicle. This considers not only make and model, but also mileage, age, specification, and location to give as accurate a gauge as possible as to how the price being offered relates to those of similar vehicles for sale, allowing you to buy with confidence.

7. Appreciation

Let’s be very clear here and say up front that used cars almost never appreciate in value; they are the exception rather than the rule. However, choose wisely and it is possible that a car’s value can creep up (or very occasionally leap) in value over time. Research is key here, as well as focusing your search on cars that were built in low volume or with a specification that made them stand out from the norm: anything, basically, that will appeal to an enthusiast in years to come.

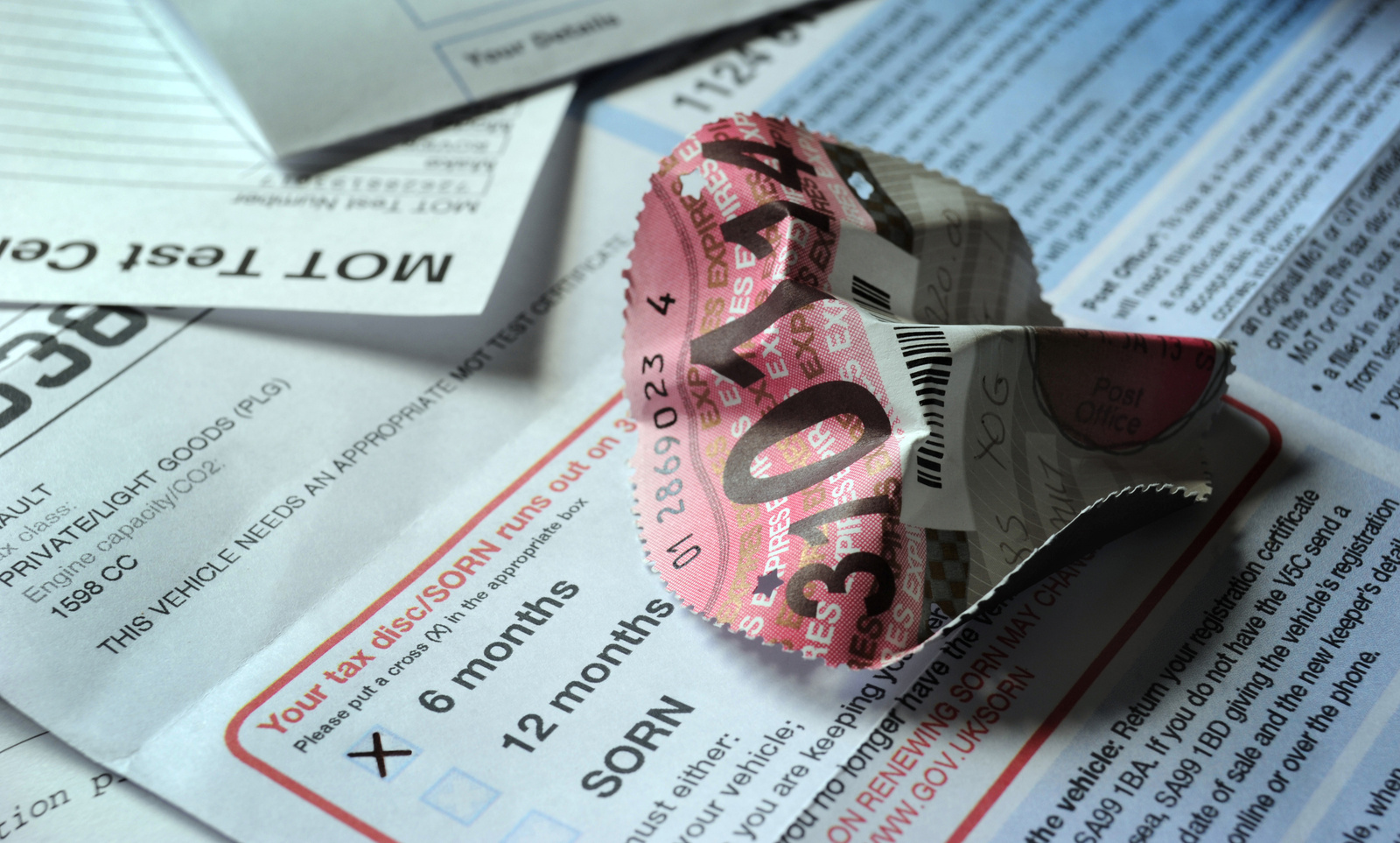

8. Beat the Tax Changes

As of April 1, 2017, the rules around Vehicle Excise Duty (road tax to most people) were overhauled. For the vast majority of new-car buyers, this means a significant increase in car tax. However, cars registered between March 1, 2001, and April 1, 2017 continue to be taxed according to the old system, which means any that emit less than 100 grams per kilometre (g/km) of CO2 won’t incur any tax at all. Those that emit 101-110g/km of CO2 cost only £20 per year to tax, and those emitting 111-120g/km are £35 per year. Compared with the post-April 2017 rates, under which only fully electric cars qualify for tax exemption (for all others you’ll pay between £10 and £2,605 for the first year, followed by a flat annual rate of £180 if it's petrol or diesel, or £170 if it's a hybrid), you stand to save several hundred pounds in tax by choosing a pre-owned vehicle rather than a new one. You can check a used car’s CO2 output by entering its details into the Government's fuel economy and emissions database.

9. History Checks

One compelling reason for buying a new car is that it won’t have any unknown history. Buy used, and at best, your new-to-you car might have a few marks and scuffs. At worst, it could be stolen, clocked, or even a cut and shut, where two halves of two different cars are welded together. However, companies such as HPI and Experian Autocheck can run a history check, examining a car’s record to tell you about any past insurance claims, and if any finance is owed, and they will try to verify the car’s mileage from past MOT tests. Approved used schemes will likely do these, too, to ensure the car is of satisfactory quality.

10. Wondering About a Warranty?

If you choose not to buy an approved used vehicle, you may still be able to find a warranty to cover it in the event something goes wrong. There are several companies that offer aftermarket warranty coverage. The cost of a policy will depend on the make, model, and age of the car, and the quality of cover varies from company to company, so be sure to shop around, read plenty of reviews, and always check the small print. If the only warranties available won’t cough up enough when your car goes wrong, it may make more sense to put a small sum of money into a savings account each month to be used for repairs or maintenance down the line.

Myth Busting: What About Insurance?

In the UK, the cost of car insurance is based on several factors, including the age of the driver, any endorsements on their licence, the car's insurance grouping and the car’s value. While a used car will almost certainly be worth less than its new equivalent, that doesn’t automatically make it cheaper to insure.

For example, new cars have more robust security features to prevent them from being broken into or stolen. As far as insurance is concerned, they also often include advanced safety systems, such as automatic emergency braking. This technology uses a camera or radar mounted in the car to scan the road ahead, and can automatically apply the brakes if it detects an imminent impact. In tests, it has been shown to reduce front-into-rear crashes by up to 40%, meaning that any car that includes it qualifies for cheaper insurance.

So, while there are many compelling reasons for choosing a used car over a new one, cheaper insurance is not necessarily one of them. That’s why, regardless of what car you’re looking at, we’d always recommend shopping around for a few insurance quotes before sealing the deal.